Sep 18, 2015

Today, I was invited to witness an interesting dialogue session with the Hon. Finance Minister of India Mr. Arun Jaitley. Many of the prominent people from Singapore came out to listen to it, as it was a prelude to Shri Narendra Modi’s visit to Singapore in November. The theme of the session was “Emerging India: Opportunity Beckons” and framed as a dialogue between the Minister and Mr. Piyush Gupta, head of DBS and an eloquent speaker and moderator in his own right. Co-hosted by FICCI and the Indian High Commission, the FICCI delegation to Singapore included CEO delegates from Indian banks and government as well as private companies. The Indian High Commissioner to Singapore prefaced the discussion by referring to the large investment flows from Singapore to India and the fact that this has seen an uptick, to $3+ b/ quarter which is higher than ever before. The FICCI president referred to the Singapore-India framework economic cooperation agreement that has been promoted on a “5S” plank: Scale up trade and investments, Speed up connectivity, Smart cities, Skill development and State focus.

The Minister highlighted many of the achievements of his government – including the advance in centre state relations, and the fact that individual states are now listing their Doing Business indicators and caring about their place in the rankings. Also, the encouraging fact that even when large landmark reforms like the Land Acquisition Act, the Labour reforms Act and the Indirect Tax (unified GST) reforms got stalled in Parliament, the Centre has tried to get it passed by individual progressive states – in this way, this provides a fillip which the rest can follow eventually when they see how beneficial it is to do reforms to get votes. He gave many examples of the excellent progress which his government has shown in the last 16 months including privatization initiatives in railways, initiatives for defence manufacturing in India, roadmap for banking reforms in India, and many future initiatives including the national investment in infrastructure fund which they are working to finalize at the earliest. He said that as government, they tried to invest their time, energy and resources in items that would have the maximum impact – in terms of de-bottlenecking the latent purchasing power of the population at large, and thereby for kick-starting growth, while still managing the budget so as to not overshoot the fiscal deficit target they have set for themselves.

Very sensible speech, impressive because the Minister was wide ranging in the topics he touched on, and frank and open too. And Mr. Piyush Gupta is not one to mince his words, so very courteously but unerringly he asked questions that was on the tip of everybody’s tongue, and the Minister was able to tackle every one- from issues like infrastructure deficit, to maintaining investor confidence, to taxation issues and the constant flip-flops on these grounds that can spook investors who are thinking of coming to India. And there were questions from the audience too- about the Look East policy having to become an Act East policy,about how Electronic Payments and greater digitization could out hope for greater transparency in money flows into and within India, and even on how to ensure that State Electricity Boards that are in the doldrums can get a rescue package that ensures that they all don’t fall into the same trap yet again.

I had a compelling question myself, which I just could not resist raising to the Minister and the august audience. My question was on how to ensure that our uniquely Indian problems are to be met with a uniquely Indian solution? On the one hand a vibrant democracy; and a surging young population with the energy, the capability and the passion, just lacking the resources to follow their dreams. On the other hand, the world is changing- and thus, centralized, supply-side, top-down and resource-driven solutions relying on economies of scale and scope, can go only so far. How would the policy makers try to unleash the demand-side solutions, and the unlimited creativity of the decentralized Indian population, to solve their own uniquely local circumstances through solutions that will make the world sit up and notice? From everything I had heard today, it seems that the government truly appreciates the scale of this challenge, and is taking steps to do exactly this- and indeed, the Minister replied courteously and exhaustively to my query, citing how the Universal Banking initiative, the impetus to Irrigation reforms, the efforts to spur greater innovation and entrepreneurship through providing framework solutions, would all be targeted at exactly this mass-scale, technology-enabled, institutional-reform driven model of governance to unleash the power of the great Indian consumer!

All in all, one of the most impressive speeches I have heard from a politician level session in India in some time. In fact, it compared very well with the kind of discussions we have gotten used to hearing from the highly educated, committed and principled minister level government functionaries here in Singapore. As the chairman of the session, Mr. Banerjee put it so eloquently- the world wants India to succeed. It’s a force for good in this world. May these noble aspirations be met with success!

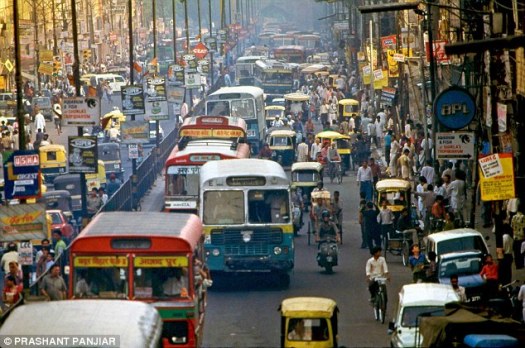

This week has been awash with distressing situations of a highly polluted smog-laden Beijing, and a flooded Chennai; with no solution to this imbroglio on the horizon. Meanwhile, pressure on maintaining an adequate, functional transport system within most cities in Asia is growing as urban areas expand and population numbers increase. In fact, most of our cities are now at a tipping point, facing challenges in that fundamental rite of urban living – getting around. But it does not have to be this way!

This week has been awash with distressing situations of a highly polluted smog-laden Beijing, and a flooded Chennai; with no solution to this imbroglio on the horizon. Meanwhile, pressure on maintaining an adequate, functional transport system within most cities in Asia is growing as urban areas expand and population numbers increase. In fact, most of our cities are now at a tipping point, facing challenges in that fundamental rite of urban living – getting around. But it does not have to be this way!

Appropriately enough, soon after we got the opportunity to listen to the Indian Railway minister, Mr. Suresh Prabhu and thereafter PM Modi in Singapore as they outlined for investors some notable aspects of the new scheme to revitalize the Indian Railways. This purports to involve redevelopment of 100+ stations across India and expected to become one of the largest PPP projects in the world. In fact, in terms of design this is very modern thinking – and ties in well with the other initiatives announced by India in recent days, such as 100 smart cities- which presumably will include all the dimensions of smart cities (from smart energy/water/waste/ transport to smart e-governance and social services) to concurrent initiatives such as Digital India, Start-up India and Clean India. However, it remains to be seen whether these undoubtedly ground-breaking initiatives can take off in face of the many challenges that governance in India presents! But if this can be done, it would be a feat unparalleled in history – for a developing nation with such a large, democratic, highly fractious populace- to do so much with so little. We can only hope that the strengths that India presents, with a highly innovative, educated workforce, ability to leverage favorable technological trends and a significant advantageous demographic dividend, can overcome these hurdles to triumph at last. From such a development, the world can only benefit.

Appropriately enough, soon after we got the opportunity to listen to the Indian Railway minister, Mr. Suresh Prabhu and thereafter PM Modi in Singapore as they outlined for investors some notable aspects of the new scheme to revitalize the Indian Railways. This purports to involve redevelopment of 100+ stations across India and expected to become one of the largest PPP projects in the world. In fact, in terms of design this is very modern thinking – and ties in well with the other initiatives announced by India in recent days, such as 100 smart cities- which presumably will include all the dimensions of smart cities (from smart energy/water/waste/ transport to smart e-governance and social services) to concurrent initiatives such as Digital India, Start-up India and Clean India. However, it remains to be seen whether these undoubtedly ground-breaking initiatives can take off in face of the many challenges that governance in India presents! But if this can be done, it would be a feat unparalleled in history – for a developing nation with such a large, democratic, highly fractious populace- to do so much with so little. We can only hope that the strengths that India presents, with a highly innovative, educated workforce, ability to leverage favorable technological trends and a significant advantageous demographic dividend, can overcome these hurdles to triumph at last. From such a development, the world can only benefit.